First Regulated US Bitcoin Exchange Opened By Coinbase

The online gambling industry is arguably the biggest consumer of bitcoins, as the virtual currency makes it extremely easy for players to make deposits and withdraw their winnings using bitcoins.

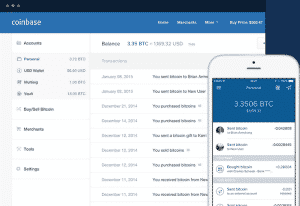

Coinbase Establishes Itself As A Leading Bitcoin Provider

Coinbase, a startup in San Francisco has been providing bitcoin services for over 38,000 vendors in 19 different countries for close to 3 years. The company has established itself to be one of the leading bitcoin providers and has a client list featuring the likes of Dell, Wikimedia and Expedia. The company also boasts of having created over 2,200,000 open wallets and a large database of over 1,900,000 users.

Coinbase Launches Bitcoin Exchange

Coinbase recently decided to launch the first regulated bitcoin exchange in the United States in order to bring a certain amount of stability to the bitcoin system that has experienced significant fluctuations in currency rates during the past few months. Coinbase confirmed that its news bitcoin exchange has been approved by the New York Stock Exchange and can currently operate in 24 US states which include California and New York. Coinbase has recruited a number of specialists who will contribute in setting up and running a successful exchange. This is great news for US based bitcoin gamblers looking for secure and regulated exchange to buy, sell and store their bitcoins.

As of now, Coinbase is only offering US based customers these exchange services but plans to make it a global offering at the earliest as one of Coinbase’s key goals is to establish itself as the world’s largest exchange. The company will face competition from Winklevoss Capital, a firm that is run by the Winklevoss twins. They recently confirmed that they planned to launch a regulated exchange to control virtual currency and will name their exchange Gemini.

While the bitcoin system has gained a lot of popularity in the last 12 months, it is still not recognized or accepted by most governments as they believe that the bitcoin system does not have sufficient regulations to govern virtual currency and has a lot of risk attached to it. Gambling companies have been more open to accepting digital currency and experimenting with bitcoins.

Coinbase Receives Venture Capital Funding

Coinbase believes that the new bitcoin exchange will play a major role in stabilizing bitcoin fluctuations and prove that this virtual currency can be used as a reliable payment method. Coinbase has secured venture capital from a number of prominent VC firms who believe it the company’s vision. Some of these firms include names such as Andreessen Horowitz, Ribbit Capital, SVAngel, IDG Ventures and Combinator. The company has raised $106 million till date and the most recent round of funding brought in over $25 million.

If Coinbase successfully manages to control and monitor the fluctuation of bitcoins, it will remove a significant percentage of risk that is associated with bitcoins and thereby help both governments across the world and merchants to be more open towards adopting bitcoins.